Nothing compares to your “first set of wheels”, no matter how many years that you are a vehicle owner. Everyone remembers their first car, whether it was a hand-me-down from Dad, or an old clunker you got dirt cheap that ran.

The biggest downer about owning your first car, or your current car for that matter, is not the amount of money you must pay for maintenance and gas for the vehicle, but the funds you expend to insure it.

But today’s cars are not your Dad’s car from back in the day. He may have just buffed out a mark where someone keyed the car or nicked the bumper. Today, just a wayward grocery store cart that slammed into a tail light or a minor or major collision may not only mess up the exterior of the car, but the electrical system may also be in peril too, thus repair costs will skyrocket. That is why you should be wise about what type of coverage you need for your vehicle.

Continue reading

The roots of insurance go way back to Babylonia, where traders were encouraged to assume the risks of the caravan trade with funds to be paid only after the goods had arrived safely. The Phoenicians and the Greeks soon hopped onto that bandwagon and utilized a similar system for their seaborne commerce. The Romans were innovative as well and used “burial clubs” as a form of life insurance, by providing funeral expenses for members and later making payments to their survivors.

The roots of insurance go way back to Babylonia, where traders were encouraged to assume the risks of the caravan trade with funds to be paid only after the goods had arrived safely. The Phoenicians and the Greeks soon hopped onto that bandwagon and utilized a similar system for their seaborne commerce. The Romans were innovative as well and used “burial clubs” as a form of life insurance, by providing funeral expenses for members and later making payments to their survivors.

Insurance premiums may sometimes seem to be the bane of your existence, but, think of the alternatives, if you had no insurance for your vehicle or/or home and there was catastrophic damage to either one? Your home is probably your largest asset, and, without adequate insurance in place, quite possibly, your finances could be wiped out in a matter of moments. You often hear stories of devastating tornadoes, and, in their aftermath, you view the shocking photos of a home with only the foundation remaining and a family gathered together looking at the devastation, but thankful that their lives were spared. When you see devastation from a tornado, a fire – or even a robbery, having good insurance in place, will help to make you and your family whole.

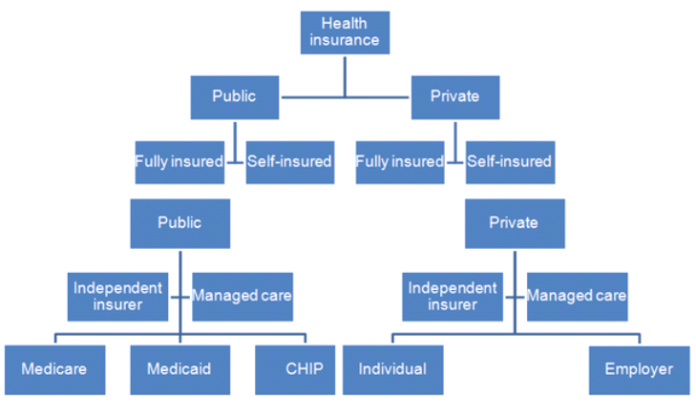

Insurance premiums may sometimes seem to be the bane of your existence, but, think of the alternatives, if you had no insurance for your vehicle or/or home and there was catastrophic damage to either one? Your home is probably your largest asset, and, without adequate insurance in place, quite possibly, your finances could be wiped out in a matter of moments. You often hear stories of devastating tornadoes, and, in their aftermath, you view the shocking photos of a home with only the foundation remaining and a family gathered together looking at the devastation, but thankful that their lives were spared. When you see devastation from a tornado, a fire – or even a robbery, having good insurance in place, will help to make you and your family whole. The world of insurance can be super complex and trying to navigate through the various types of insurance to find exactly what is necessary and what is not can be confusing. Before you contact the insurance company, it is important to be familiar with the different types of insurance available and which ones you actually need. Then a

The world of insurance can be super complex and trying to navigate through the various types of insurance to find exactly what is necessary and what is not can be confusing. Before you contact the insurance company, it is important to be familiar with the different types of insurance available and which ones you actually need. Then a